Payment Links: An Easier Way to Get Paid

FinTech

Web Browser

2022

Why Payment Links

Let’s face it—getting paid shouldn't be rocket science, right? But for small business owners, freelancers, and nonprofits, managing payments was becoming a hassle. That’s where payment links stepped in. Think of it as a no-fuss way to request payments, accept donations, or manage transactions—without the tech headaches of setting up an entire e-commerce platform. Just send a link, and boom, you’re done!

Take Sarah, for example, a direct seller in the beauty and fashion space, juggling orders and payments through Facebook. Keeping track of who had paid for what was an impossible task. Payment links could’ve made her life way easier—a streamlined way to handle payments without getting lost in a sea of DMs. All branded and customizable.

What Were We Solving?

It’s simple: too many small businesses were using solutions that were way too complex for what they needed. They wanted a quick, easy way to get paid—without the endless setup or third-party integration headaches.

Here’s what we were up against:

Too Complex: Most payment platforms felt like overkill for small businesses. Who has time for all that setup?

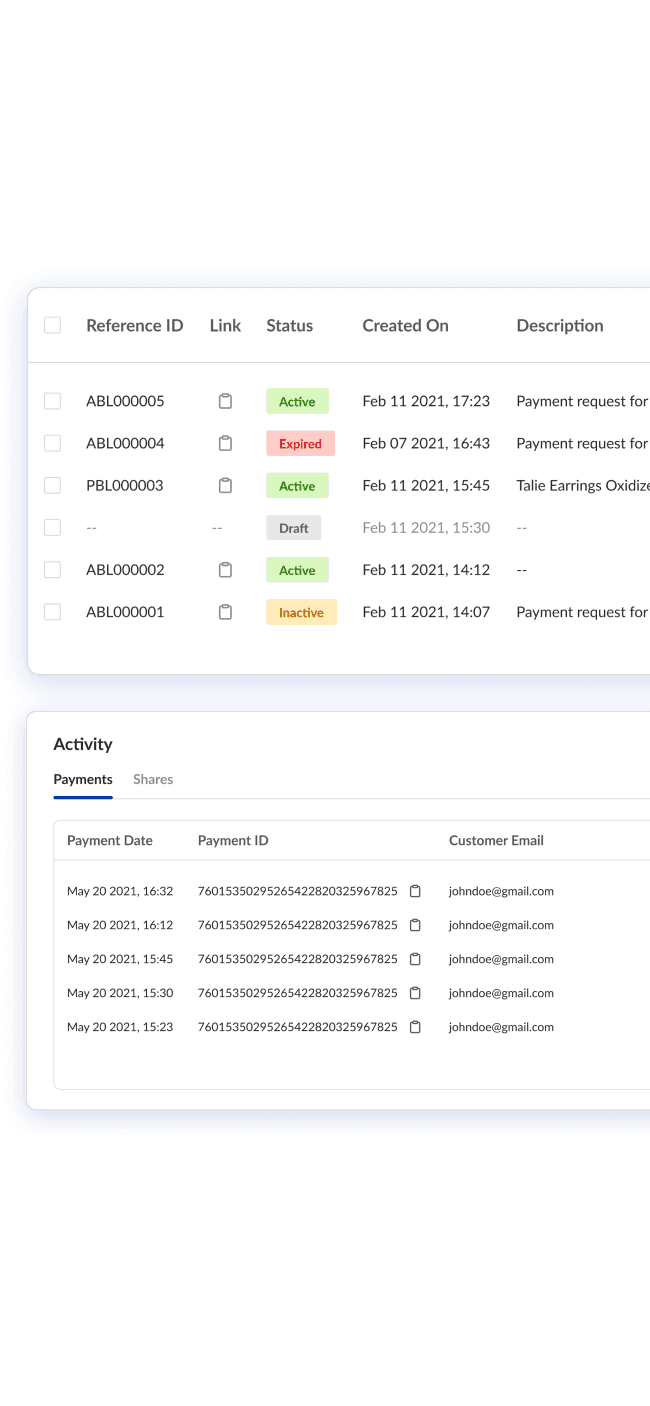

Manual Tracking Mess: Payment tracking was often manual, leaving room for errors (and wasted time).

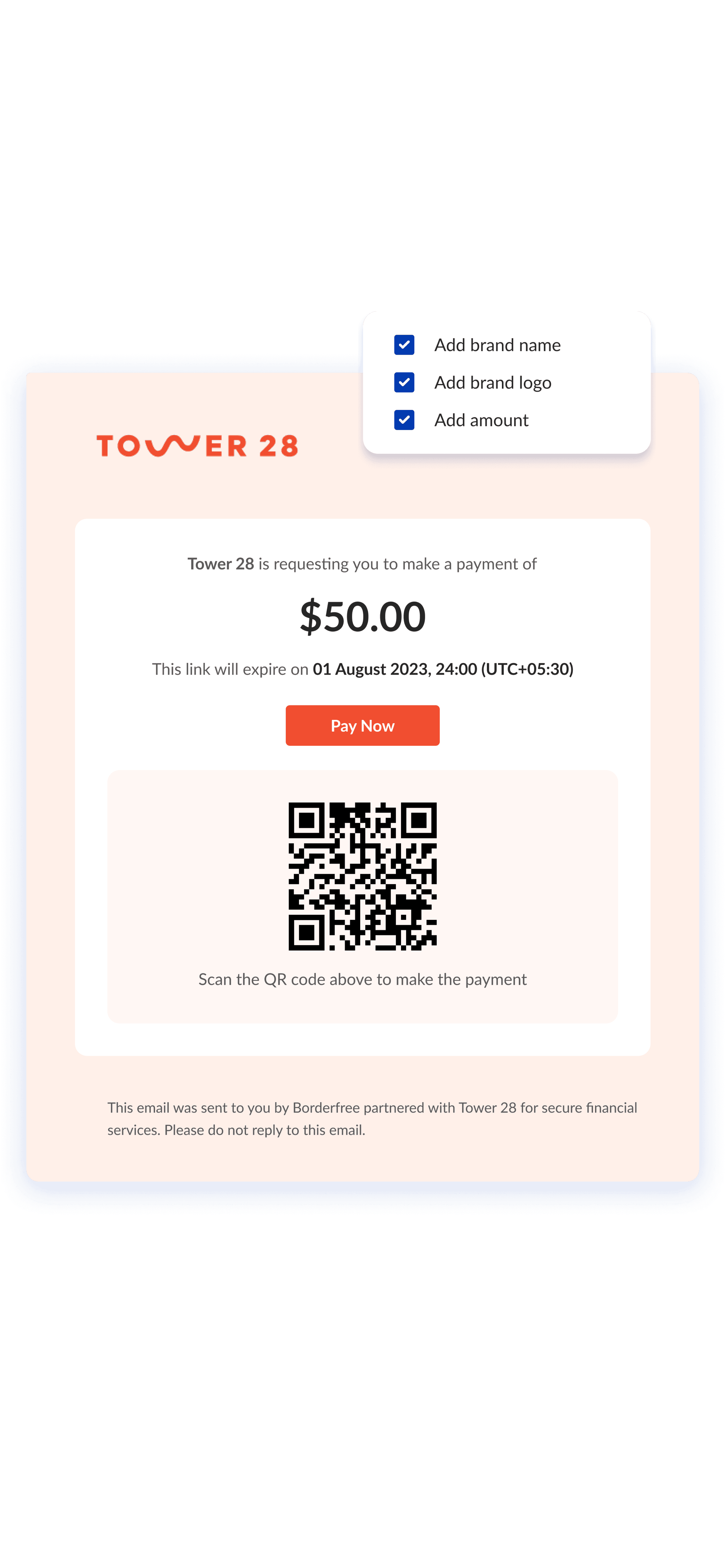

Lack of Customization: Businesses couldn’t personalize the payment experience to reflect their brand. Missed opportunity, right?

Who's It For?

Payment Links is a versatile tool that serves a wide a range of users:

Small Businesses

Substitute cash on delivery or point-of sale payment methods with payment links.

Freelancers

Whether you're an individual selling products or services online, this tool simplifies accepting payments.

Nonprofits

Need donations? Send a secure, simple payment link to keep track payments.

Digging Into the Challenges

We did our homework—deep dives into competitor solutions and user interviews to understand what our target audience was really struggling with. Some of the biggest pain points we found:

Keeping Engagement Post-Payment: Merchants wanted a way to redirect customers to their website, social media, or blog after completing the transaction. You know, to keep the relationship going.

Confusing Payment Links: Merchants were often lost, especially with numeric IDs instead of meaningful labels. Not exactly user-friendly.

Notification Blackouts: Merchants wanted to know when their payment links expired or when a transaction came through. No one likes being left in the dark.

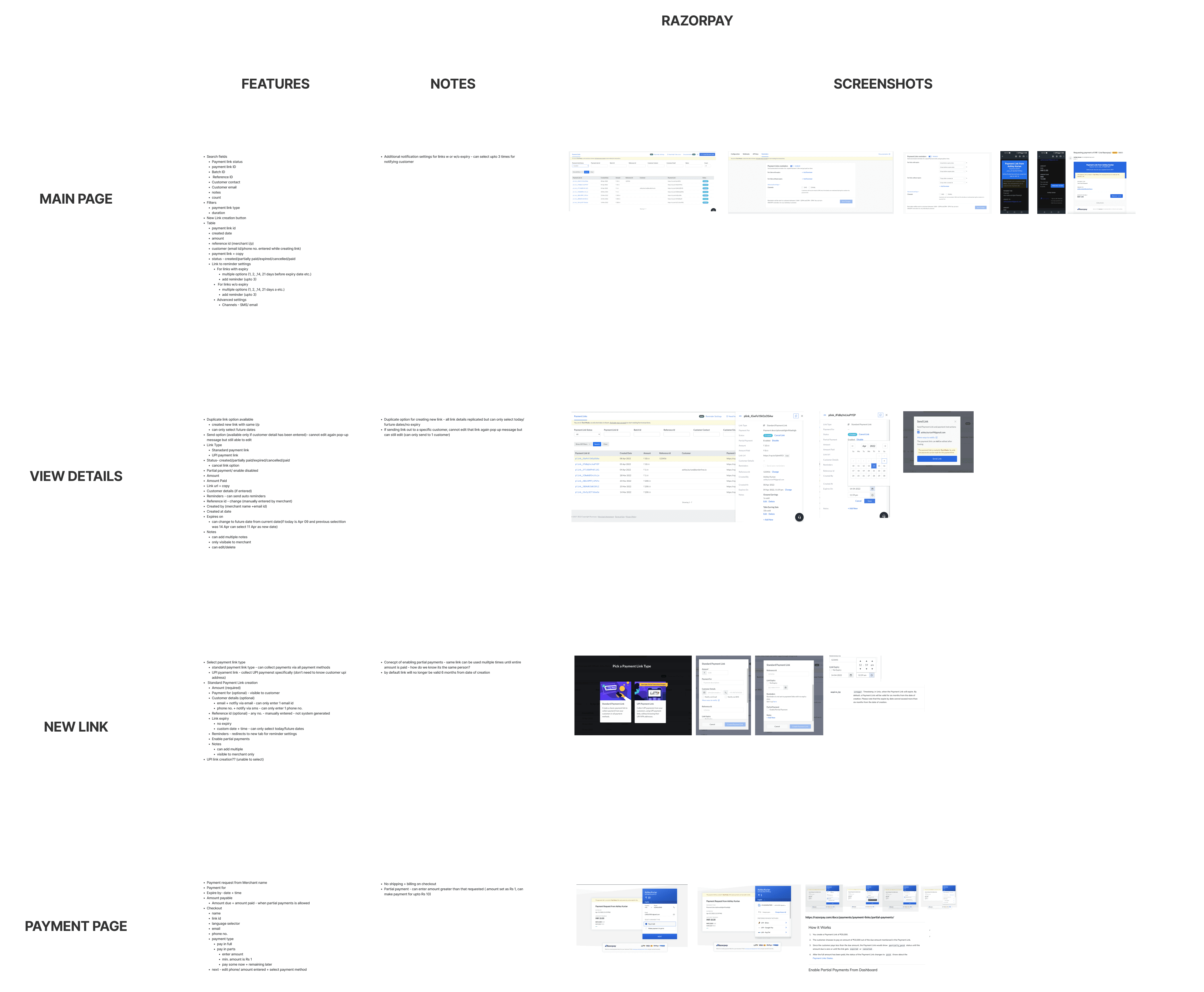

Competitor Analysis

Early Concepts

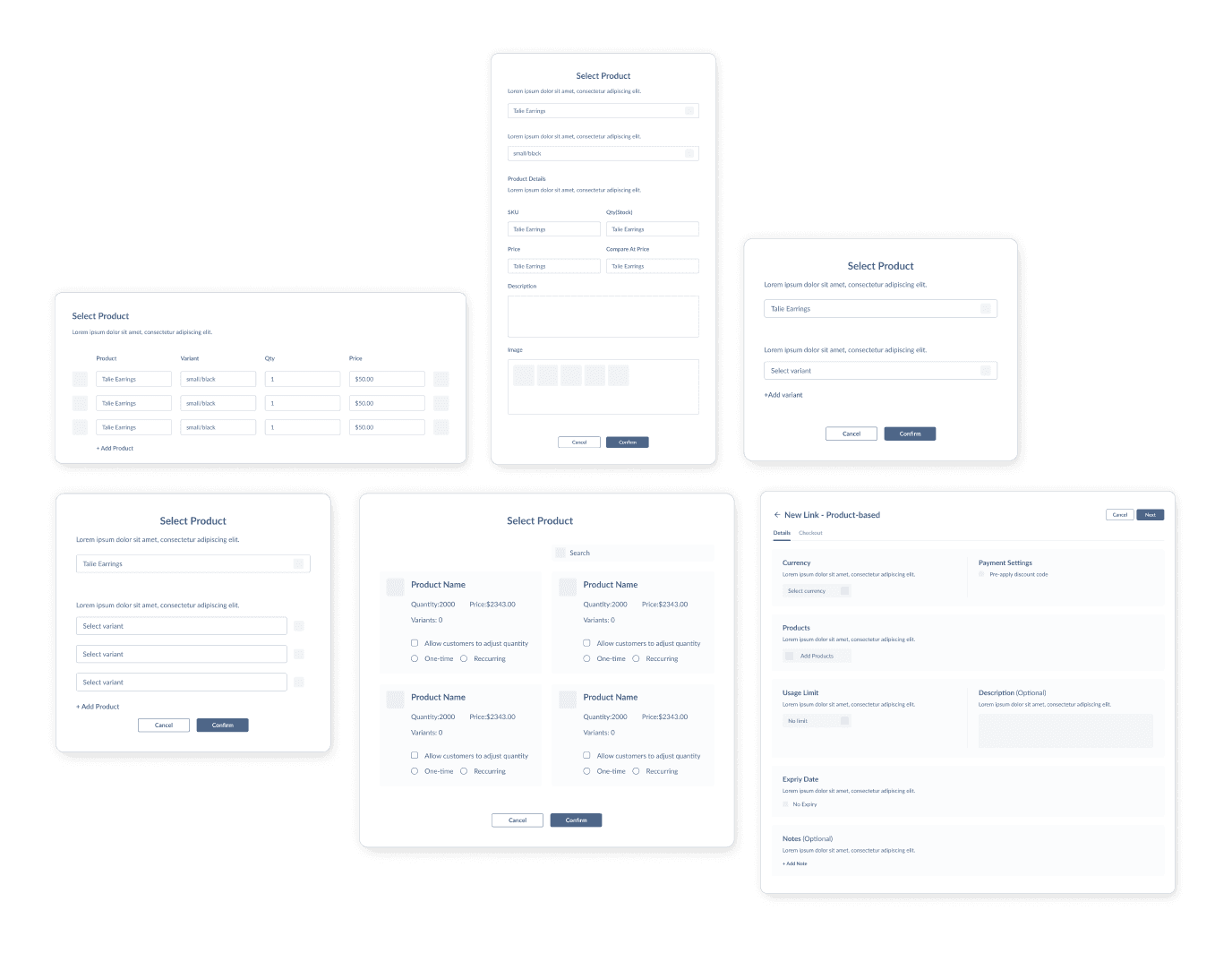

We kicked things off with wireframes—just enough to test out the basic flow. Using existing components sped things up, ensuring consistency across the platform. Feedback from real users helped us make rapid tweaks to the design, making sure we got it right.

Wireframes

From Problem to Solution

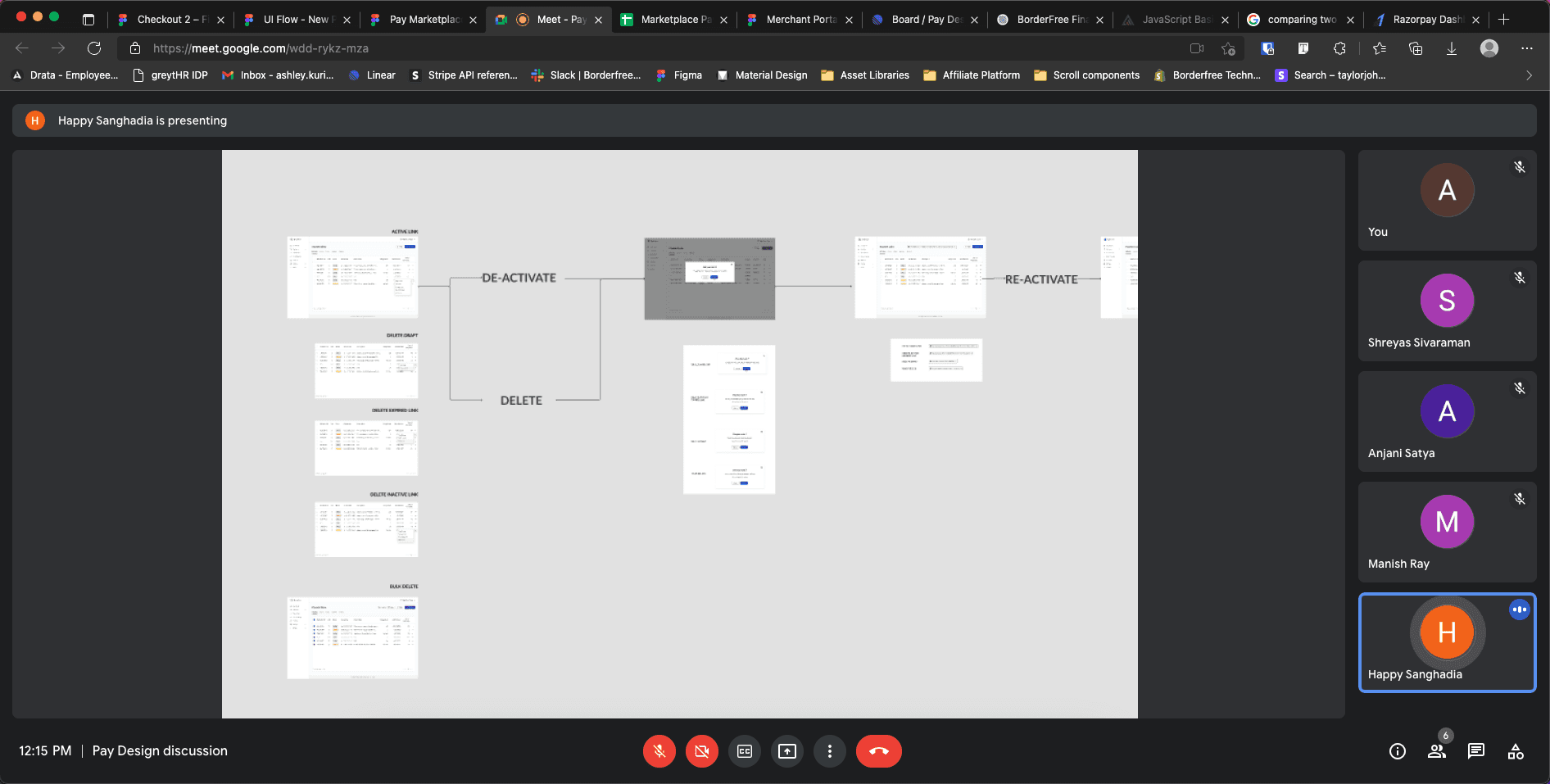

With all these insights in hand, we got to work. Collaborating closely with the product and tech teams, we moved fast—prototyping, testing, and refining until we had something both simple and powerful.

Feedback Sessions

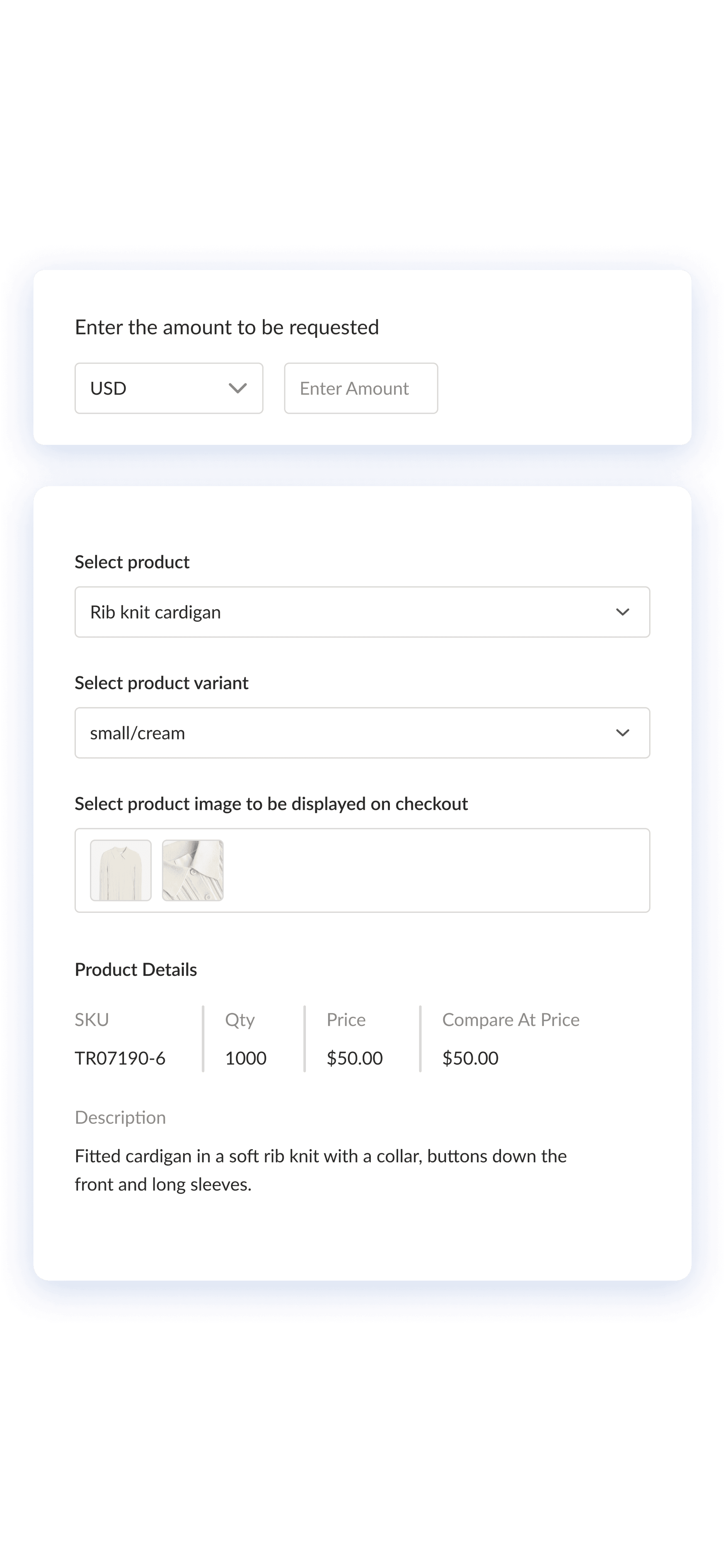

Three Simple Steps to Get Paid

Expected Results

Although we didn’t get to launch Payment Links, the potential was undeniable:

Happier Customers

Custom-branded, easy payment experiences meant customers stuck around longer.

Fewer Abandoned Payments

Simplifying the process meant fewer drop-offs at the payment stage.

Opportunities to Upsell

Merchants could direct customers to other products, services, or donation options after they made their payment.

Wrapping It Up

Payment Links was all about simplifying something that was way too complicated. By focusing on the needs of small business owners, freelancers, and nonprofits, we explored creating a tool that let them get paid without the hassle so that they could get back to what really mattered—growing their business.